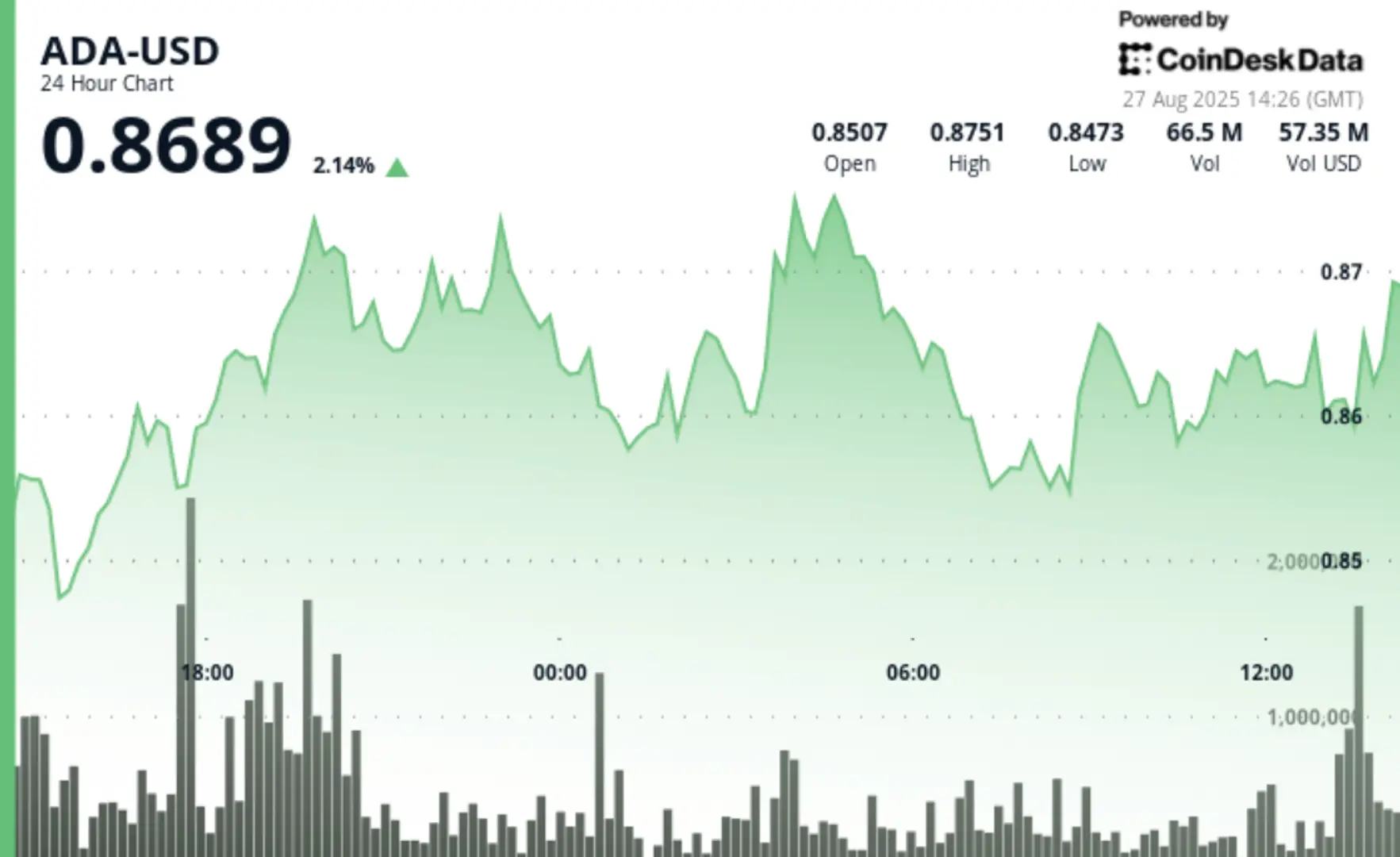

Cardano’s ADA token climbed 2% to $0.87 in the past 24 hours, echoing a broader recovery across crypto markets. The CoinDesk 20 Index (CD20), which tracks the largest digital assets, gained 2.8% over the same period.

The move came as traders weighed two major developments: growing confidence in a September interest rate cut by the Federal Reserve and the U.S. Securities and Exchange Commission’s (SEC) decision to extend its review of Grayscale’s proposed spot Cardano exchange-traded fund (ETF) until late October 2025.

ADA traded in a tight but volatile $0.04 band, swinging between a low of $0.83 and a high of $0.88, according to data from CoinDesk Analytics. That spread of roughly 5% reflected heightened activity. At one point, the token broke sharply higher, surging from $0.84 to $0.88 on trading volumes that more than doubled the 24-hour average of 39.3 million.

📖 Related Reading

- 📰 CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

- 📰 GENIUS was just the prologue. Stablecoins represent a platform shift in payments. The stage is set.

After the breakout, ADA settled into consolidation. Traders pegged resistance at $0.88, with new support forming around $0.85. Late-session action saw the price stabilize at $0.86, a level analysts say may point to institutional accumulation ahead of another potential rally.

The broader market backdrop has been choppy. Crypto assets fell sharply Monday as traders locked in profits from a weekend surge sparked by Fed Chair Jerome Powell’s dovish remarks in Jackson Hole. Those comments fueled expectations of rate cuts, which typically support risk assets like cryptocurrencies by making traditional yields less attractive. By Tuesday, investors appeared to treat the pullback as a buying opportunity, helping altcoins rebound.

Lower interest rates often act as a tailwind for the crypto sector, where investors hunt for higher returns compared with government debt. Historically, such conditions have set the stage for “altcoin season,” periods where smaller tokens outperform bitcoin (BTC) during consolidation phases.

Meanwhile, the SEC’s delay of Grayscale’s Cardano ETF was widely anticipated, as the regulator has slowed nearly all spot crypto ETF decisions. While the news briefly injected uncertainty, ADA’s resilience suggested traders were more focused on broader market momentum and capital rotation from bitcoin into altcoins.

🔗 You Might Also Be Interested In

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

GENIUS was just the prologue. Stablecoins represent a platform shift in payments. The stage is set.

Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!