Ether (ETH) set a new all-time high at $4,946 earlier this week, but the fuel from on-chain finance looks weaker than in prior cycles.

However, the total value locked (TVL) across the network’s decentralized finance (DeFi) ecosystem stalled at $91 billion, significantly below the $108 billion record set in November 2021, according to DefiLlama data.

In ETH terms, the gap is sharper: just under 21 million ETH are locked on Tuesday, compared to 29.2 million ETH in July 2021. Even earlier this year, the figure topped 26 million ETH. That means fewer tokens are actively tied up in DeFi than at any point since the protocol hit its price highs.

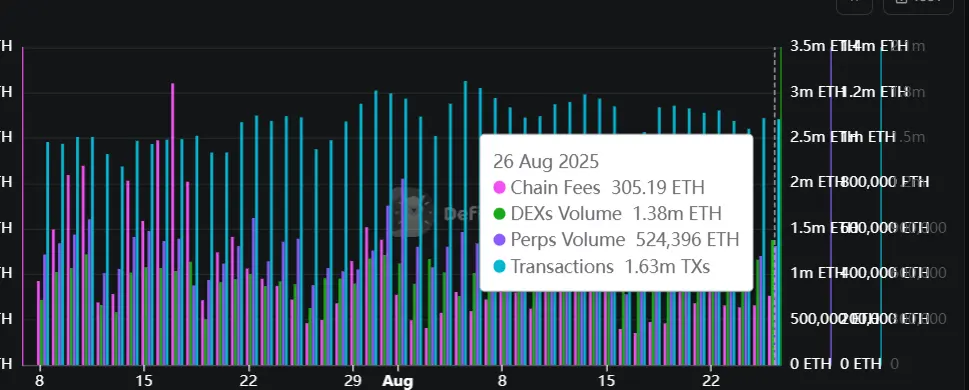

Charts show the disconnect. DEX volumes and perps flows remain active, but they have not returned to past peaks even with prices breaking fresh records.

Layer 2s scoop up liquidity

Part of the shift is structural as layer 2s draw inflows. Coinbase-backed Base’s DeFi TVL is standing tall at $4.7 billion, alongside the growth of Arbitrum and Optimism. Capital efficiency has also changed the equation, with staking protocols like Lido concentrate liquidity without requiring the same bulk deposits that once inflated raw TVL.

“Despite ETH reaching record new highs, its TVL remains below past records due to a combination of more efficient protocols and infrastructure, as well as increased competition from other chains amid a lull in retail participation,” said Nick Ruck, director at LVRG Research, in a Telegram message.

“To reclaim those TVL peaks, we’d need a resurgence in retail DeFi engagement, broader adoption of Ethereum-native yield opportunities, and a slowdown in capital migration to competing chains or off-chain investments. Ethereum’s scaling solutions also need to balance efficiency with incentivizing robust on-chain liquidity to drive TVL growth,” Ruck added.

📖 Related Reading

- 📰 Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

- 📰 CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

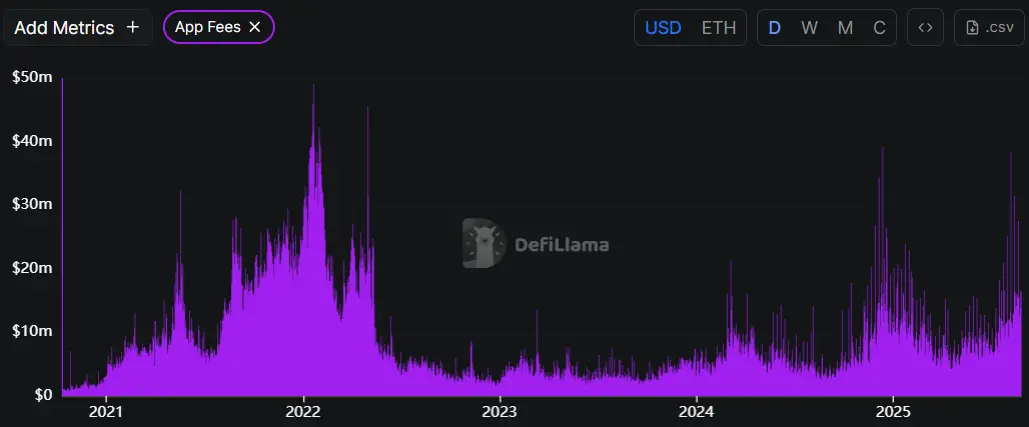

Back in 2020 and 2021, TVL was the market’s favorite growth metric. “DeFi Summer” turned yield farming into a speculative loop, with tokens flooding into Maker, Aave, Compound, and Curve in search of double- and triple-digit returns.

The rapid climb in TVL became a shorthand for Ethereum’s dominance and eventually a signal of price momentum. But that dynamic looks weaker this cycle. Volumes on DEXs and perpetuals remain steady, but they haven’t returned to levels that once defined Ethereum’s breakout.

Structural shifts hit DeFi

Part of the shift is structural. The rise of liquid staking protocols like Lido has made capital more efficient, concentrating liquidity without requiring the bulk deposits that once inflated TVL.

The divergence also reflects how this cycle is being driven. ETF inflows, institutional allocations, and macro positioning have been the dominant catalysts for ETH’s record price, with net assets on such products jumping from $8 billion in January to over $28 billion as of this week.

Retail DeFi activity, the fuel of prior booms, has yet to follow. That leaves ETH looking less like the center of grassroots crypto speculation and more like a macro asset.

For ETH bulls, the hope is that record prices eventually reignite on-chain experimentation and pull capital back into DeFi.

Until then, the gap between token value and protocol usage serves as a reminder that this cycle is unfolding differently. If on-chain engagement doesn’t return, ETH’s record prices could end up leaning on thinner foundations than bulls would like to admit.

🔗 You Might Also Be Interested In

Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!