Data provider RedStone has released a new report on Hyperliquid, the decentralized perpetuals exchange that has quickly become the category leader.

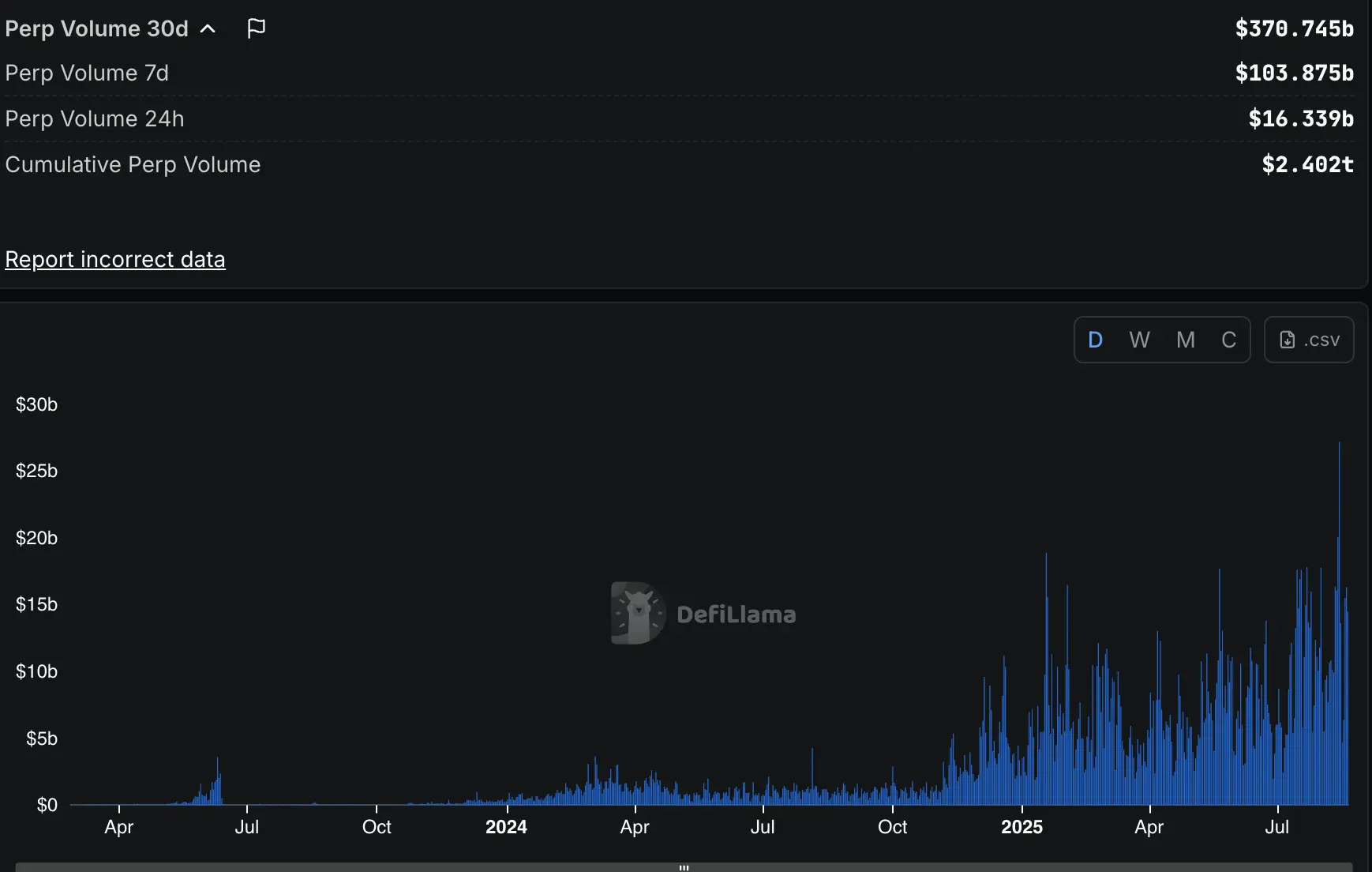

In just a year, Hyperliquid has grown to capture more than 80% of the decentralized perps market, with daily trading volumes now topping $30 billion, rivaling some of the largest centralized exchanges, according to the report.

RedStone highlighted three structural advantages that underpin Hyperliquid’s surge.

The first is its fully on-chain order book that now delivers spreads and execution speeds on par with centralized platforms.

Second, HIP-3, Hyperliquid’s new permissionless market creation framework, has created one of the most active builder ecosystems in DeFi, with revenue-sharing economics that pay developers more than the protocol itself.

📖 Related Reading

- 📰 CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

- 📰 Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

And third, its dual architecture of HyperCore and HyperEVM enables entirely new financial primitives, including tokenized perp positions, delta-neutral strategies, and novel liquidity engineering tools.

Hyperliquid’s rise is an indication of how a lean, self-funded team can outcompete venture-backed peers by focusing on technical execution and builder-first incentives. By coupling CEX-level performance with permissionless technology, Hyperliquid is positioning itself not just as a trading venue but as a potential backbone for the next phase of on-chain trading.

The Hyperliquid network, on which the Hyperliquid DEX is based, currently has around $2.2 billion in total value locked, with the DEX notching $330 billion in cumulative trading volume in the past 30 days, according to DefiLlama.

“Hyperliquid is setting a new standard,” the RedStone report notes, arguing that the platform’s dual-layer design and community-driven growth model are creating “unprecedented opportunities for builders and institutions alike.”

🔗 You Might Also Be Interested In

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!