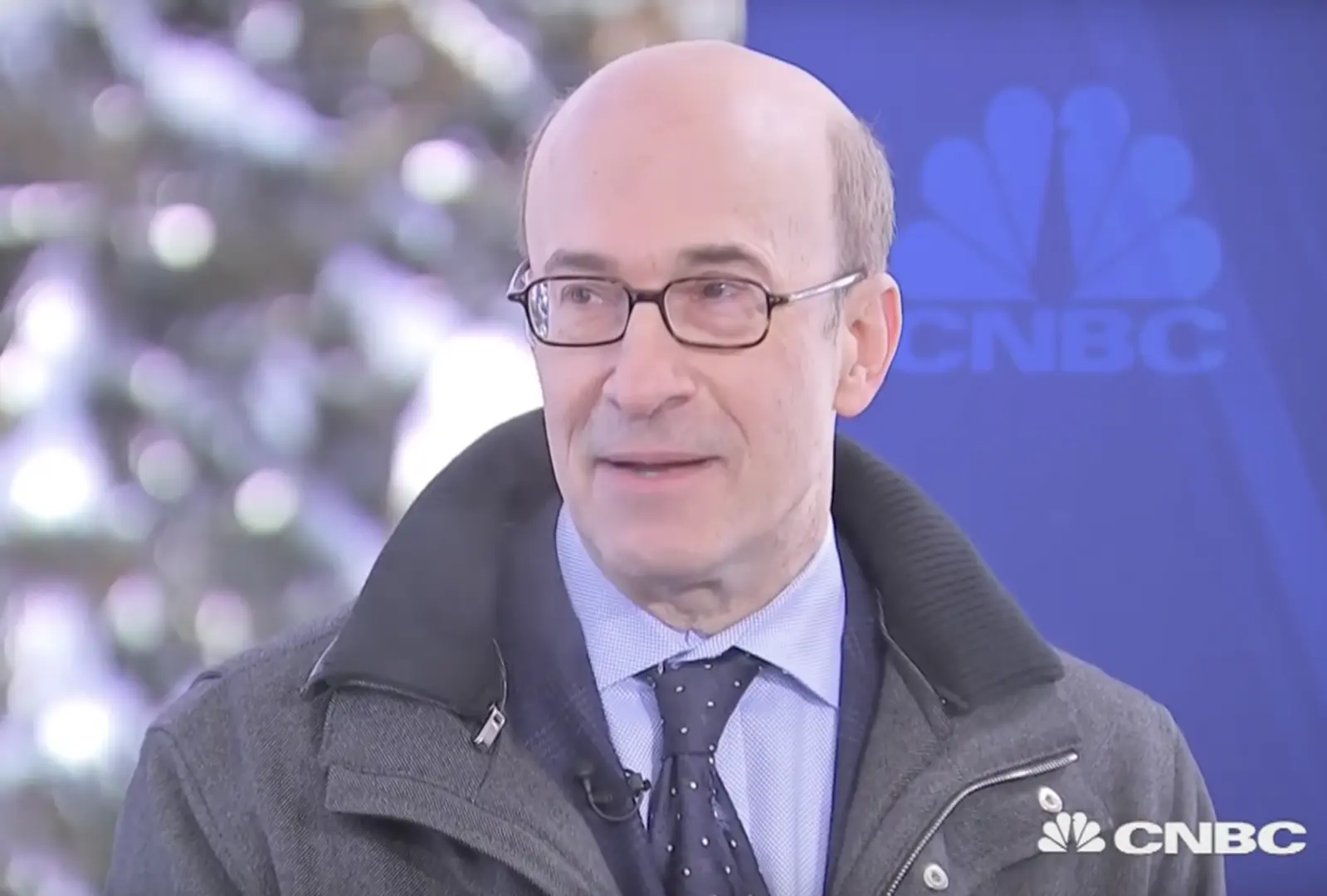

In 2018, Kenneth S Rogoff, professor of economics at Harvard University and a former chief economist at the International Monetary Fund, predicted bitcoin (BTC) was more likely to be worth $100 than $100,000 in a decade.

In reality, bitcoin’s price rose above $100,000 this year, a 10-fold increase from March 2018’s sub-$10,000 level when Rogoff predicted the crash.

On Tuesday, with bitcoin hovering around $113,000, Rogoff reflected on how he had missed the mark, saying he had been “far too optimistic about the U.S. coming to its senses regarding sensible cryptocurrency regulation.”

📖 Related Reading

- 📰 S&P Assigns First-Ever Credit Rating to a DeFi Protocol, Rates Sky at B-

- 📰 Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

In a post on X, Harvard economist Ken Rogoff expressed said he’d expected policymakers to adopt a firm stance to curb the use of cryptocurrencies in tax evasion and illegal activities. He was, indirectly, criticizing the regulatory environment as being less than prudent and allowing cryptocurrencies like BTC to flourish in ways he did not anticipate.

Rogoff underestimated how bitcoin would compete with fiat currencies to serve as the transaction medium of choice in the 20 trillion-dollar global underground economy.

“This demand puts a floor on its price, as I discuss at length in my new book Our Dollar, Your Problem,” Rogoff said.

He also flagged a “blatant conflict of interest,” with regulators “holding hundreds of millions (if not billions) of dollars in cryptocurrencies seemingly without consequence.”

🔗 You Might Also Be Interested In

S&P Assigns First-Ever Credit Rating to a DeFi Protocol, Rates Sky at B-

Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!