Emails race across the globe in milliseconds, yet money still moves at a crawl. It can take days to make payments, especially cross-border — longer over weekends or holidays. The result? Trillions of dollars are trapped where they can’t earn yield.

This inefficiency is more than an inconvenience — it is a systemic drag. For companies and financial institutions, delayed access to liquidity means higher costs, constrained working capital and a structural handicap in a world that expects everything in real real-time.

Stablecoins as the catalyst

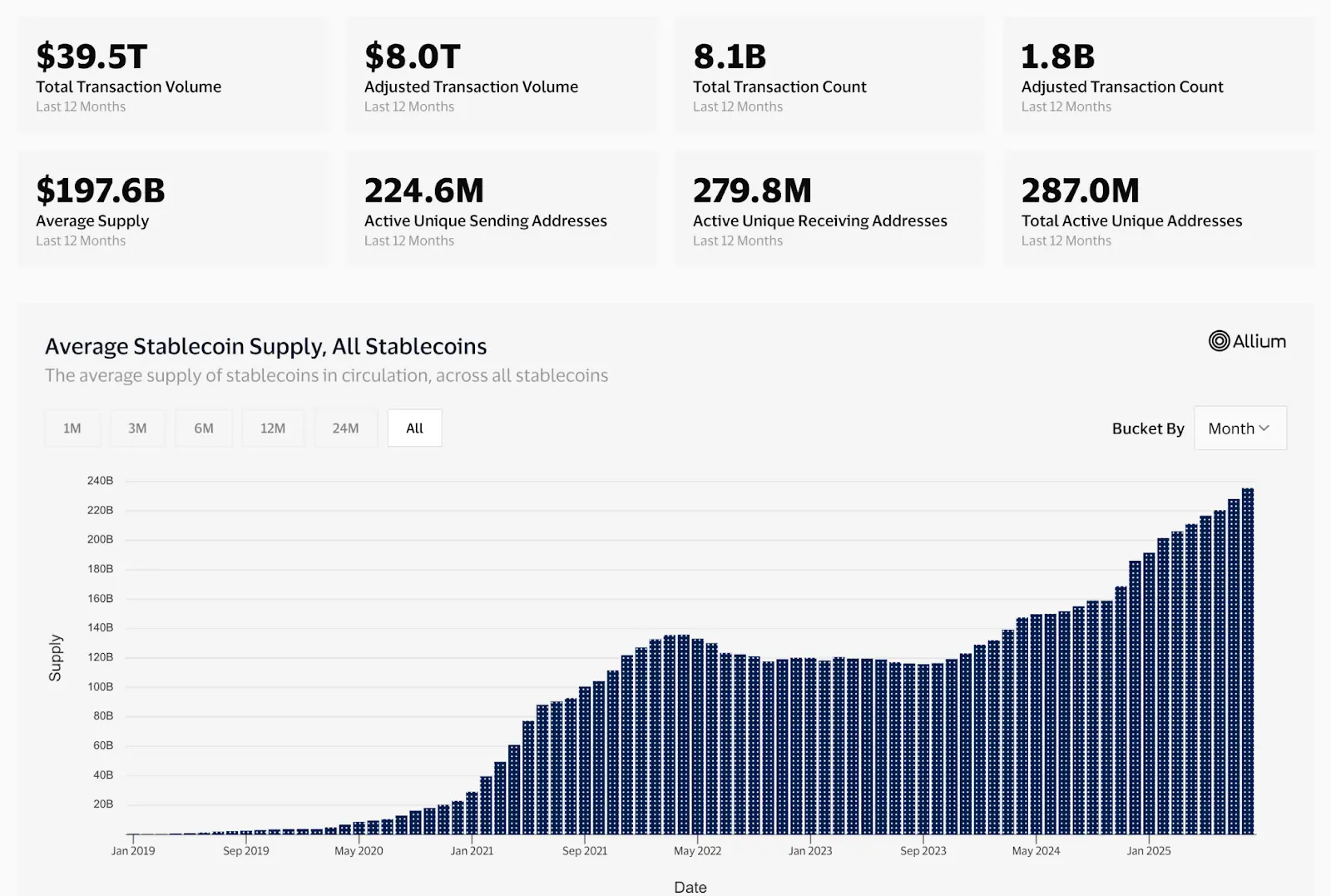

The advent of stablecoins proved that money could move at the speed of the internet. Today, trillions of dollars’ worth of transactions settle instantly on blockchain rails, with stablecoins providing the dollar liquidity that powers crypto markets, payments and remittances. But stablecoins themselves only solve half the problem.

Source:https://visaonchainanalytics.com/

They provide speed, not yield. Stablecoin balances, in aggregate hundreds of billions of dollars, typically earn nothing. Contrast that with tokenized treasury **** assets and money market funds, which are low-risk, yield-bearing instruments that pay the risk-free rate. The challenge is that subscriptions and redemptions into and out of these products still run on asynchronous, often T+2 timelines locking out investable capital needed in the immediate term.

Convergence and composability

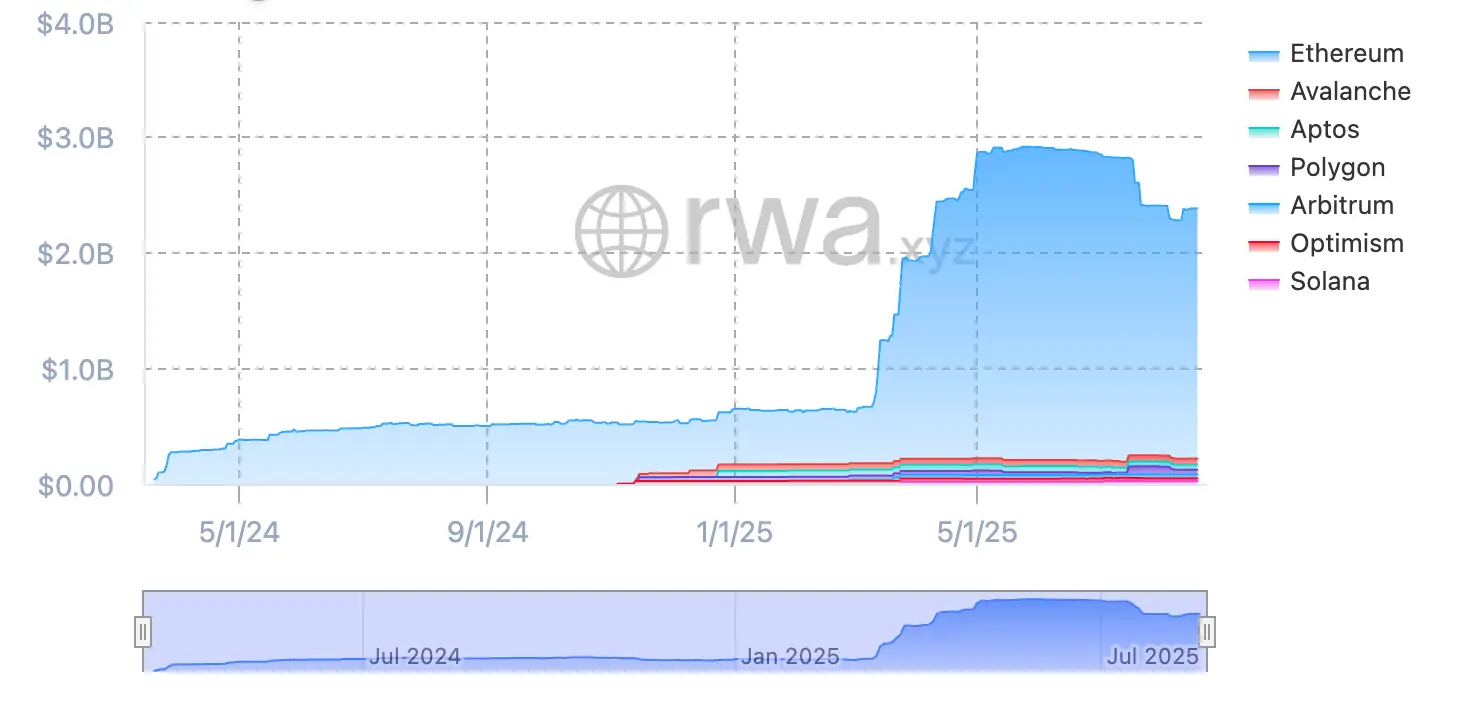

The industry now stands on the cusp of convergence. The world’s leading asset managers now offer tokenized money market funds, with BlackRock’s BUIDL for example topping $2 billion in assets under management.

📖 Related Reading

- 📰 CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

- 📰 Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

Source:https://app.rwa.xyz/assets/BUIDL

These tokenized funds can transfer and settle instantly, including atomically, against other tokenized instruments like stablecoins. As stablecoin activity increases, so do cash and treasury management needs for which tokenized **** treasuries are the optimal solution.

What’s missing is the connective tissue. Without neutral infrastructure to enable atomic, 24/7 swaps between stablecoins and tokenized treasuries , we are only digitizing old constraints. The true breakthrough comes when institutions can hold risk-free assets and instantly convert them to cash at any hour, without intermediaries, delays or price slippage.

The stakes

The stakes are enormous. In the U.S. alone, non-interest-bearing bank deposits total nearly $4.0 trillion. If even a fraction were swept into tokenized treasuries and made instantly convertible to stablecoins, it would unlock hundreds of billions of dollars in yield while preserving full liquidity. That is not a marginal efficiency — it is a structural shift in global finance.

Critically, this future requires open, neutral and compliant infrastructure. Proprietary walled gardens may deliver efficiency for one institution, but systemic benefits only emerge when incentives align across issuers, asset managers, custodians and investors. Just as global payment networks required interoperable standards, tokenized markets need shared rails for liquidity.

The path forward

The liquidity gap is not a technical inevitability. The tools exist: tokenized risk-free assets, programmable money and smart contracts capable of enforcing trustless, instant settlement. What is needed now is urgency — by institutions, technologists and policymakers — to bridge the gap.

The future of finance is not merely faster payments. It is a world where capital is never idle, where the trade-off between liquidity and yield disappears and where the foundations of financial markets are rebuilt for an always-on, global economy.

That future is closer than most realize. Those who embrace it will define the next era of financial markets; those who hesitate will be left behind.

🔗 You Might Also Be Interested In

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

Crypto Market Cap Halts at $3.7T as Traders Rotate Out, Institutions Double Down on BTC, ETH

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!