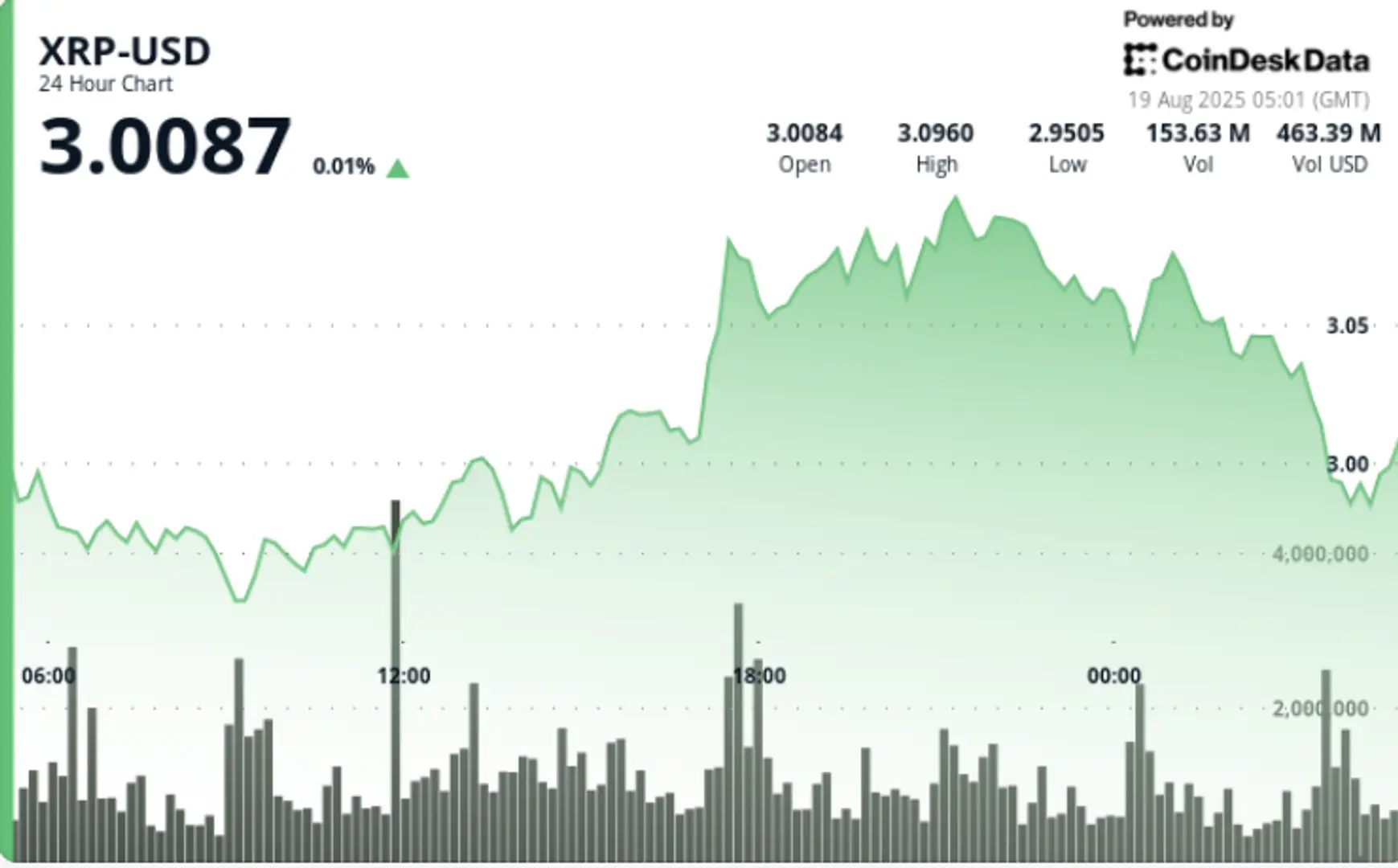

XRP closed Monday’s session under pressure, reversing an earlier rally and ending near the $3.00 threshold. A sharp selloff in the final trading hour saw the asset dip 1% on surging volume, suggesting institutional distribution and stop-loss liquidations driving price action.

Technical Analysis Shows Mixed Signals

XRP traded within a $0.11 range between $2.94 and $3.10 across the 24-hour session from August 18 05:00 to August 19 04:00, representing nearly 4% intraday volatility. A bullish breakout during the 17:00 trading hour on August 18 pushed prices from $2.97 to $3.10, supported by heavy volume of 131 million—double the 24-hour average of 66.8 million. This established short-term support near $3.00.

Momentum faded quickly, however. The token rejected multiple times at $3.09, sliding into consolidation around $2.99. An aggressive pullback unfolded during the 03:00 hour on August 19, when XRP dropped from $3.04 to $2.99.

Key Market Movements

📖 Related Reading

- 📰 Winklevoss’ Gemini submits confidential IPO filing amid renewed investor confidence

- 📰 Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

• XRP declined 1% in the final 60 minutes, sliding from $3.03 to $2.99 as volumes spiked to 5.26 million—five times the hourly average

• Distribution pressure accelerated around the $3.00 psychological threshold, triggering stop-loss liquidations during the 03:43–03:46 interval

• A bullish surge earlier in the session (August 18 17:00) lifted XRP from $2.97 to $3.10 on 131 million volume, far above average activity

Market Dynamics Drive Sharp Reversal

The late-session breakdown confirmed institutional selling near $3.00, erasing the earlier breakout’s momentum. While $2.99 provided intraday stabilization, the volume-backed rejection at $3.09 highlights growing resistance pressure.

XRP now sits at a crossroads: holding above $2.99 could allow bulls to retest the $3.08–$3.09 cluster, while failure risks a deeper correction toward the $2.96 demand zone.

Technical Indicators Summary

• Range: $0.11 (3.8%) between $3.10 peak and $2.94 trough

• Resistance: $3.09, rejected repeatedly through evening sessions

• Support: $3.00 psychological level, tested under high-volume distribution

• Risk: Breakdown toward $2.96 demand zone if $2.99 fails

• Signal: Bullish triangle structure intact, but momentum fading under profit-taking

🔗 You Might Also Be Interested In

Winklevoss’ Gemini submits confidential IPO filing amid renewed investor confidence

Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!