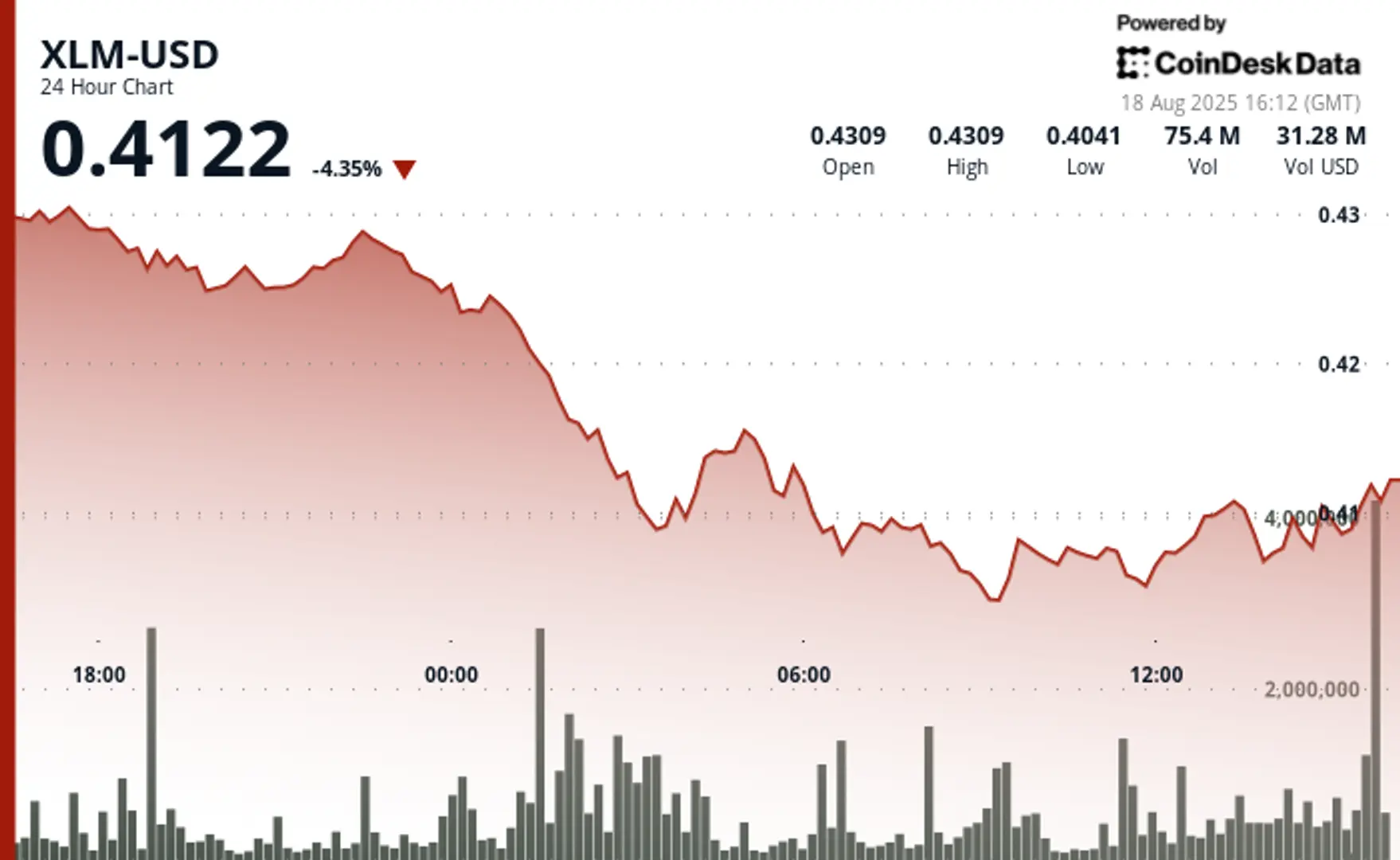

Stellar’s XLM token came under heavy institutional selling pressure between August 17 at 3:00 PM and August 18 at 2:00 PM, sliding from $0.43 to $0.41 in a 6% decline.

Trading volumes during the 24-hour period topped $30 million, representing roughly 7% of daily turnover.

The most notable liquidation event occurred between 1:00 AM and 3:00 AM on August 18, when institutional sellers offloaded more than 60 million tokens. This selloff forced XLM down from $0.42 to $0.41, creating strong resistance at the $0.42 level and defining new support near $0.41.

Despite attempts at recovery, the asset consistently failed to breach the resistance zone, signaling persistent institutional bearishness and leaving XLM vulnerable to further downside.

📖 Related Reading

- 📰 CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

- 📰 Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

The final trading hour on August 18 added fresh pressure, as XLM registered a 1% drop between 1:21 PM and 2:20 PM. Institutional selling accelerated between 1:31 PM and 1:42 PM, with corporate liquidations pushing prices from $0.41 to $0.41 on volumes exceeding 2.7 million units.

This flurry of activity confirmed resistance at $0.41 and set a short-term support floor at the same level. Multiple recovery attempts throughout the hour were met with renewed selling pressure, culminating in a stagnant close around $0.41 with minimal volume in the last 20 minutes.

The lack of buying interest highlights the possibility of further weakness should sellers regain momentum.

** Disclaimer:** Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk ’s full AI Policy.

🔗 You Might Also Be Interested In

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!