Dogecoin slid overnight, erasing gains despite heavy institutional accumulation, as $782 million in trading volume overwhelmed support levels and sent the token into correction mode.

The move came alongside broad crypto liquidations, reflecting heightened macro pressure.

News Background

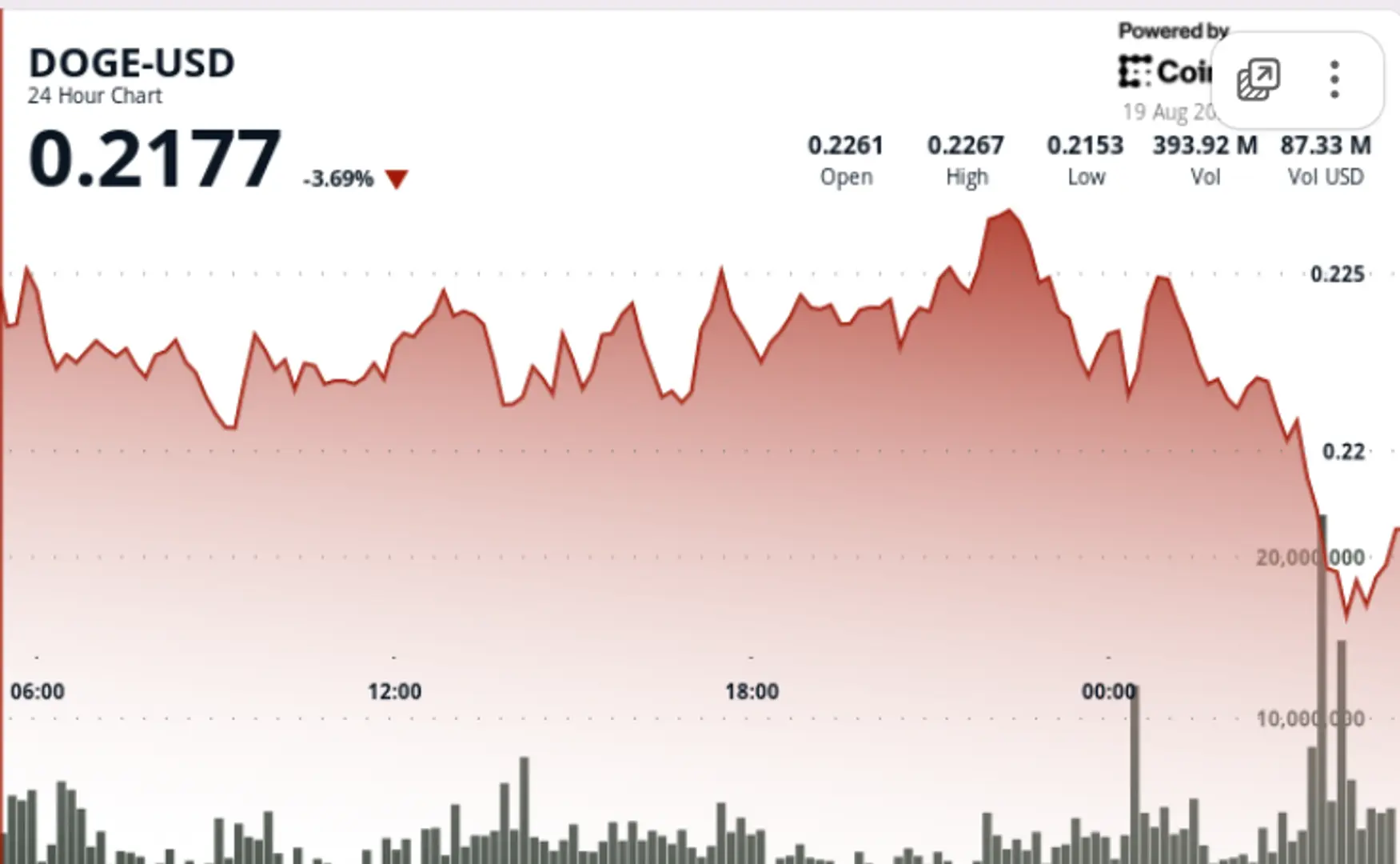

• Dogecoin dropped from $0.23 to $0.22 in a 24-hour window ending August 19 at 04:00, marking a 4% decline.

• A sharp liquidation wave hit between 03:00-04:00, where volumes spiked to 782 million DOGE — nearly double the daily average.

• The decline occurred as industry-wide liquidations topped $1 billion, triggered by U.S. inflation prints beating expectations and denting Fed rate-cut hopes.

• Despite the drop, institutional buyers have accumulated 2 billion DOGE worth about $500 million this week, bringing total reported holdings to 27.6 billion.

Price Action Summary

📖 Related Reading

- 📰 Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

- 📰 Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

• DOGE traded within a $0.01 band, reflecting 5% intraday volatility.

• Overnight crash drove the token to test $0.22 support, now viewed as the key level to defend.

• A late-session rebound attempt lifted prices modestly back toward $0.22, signaling demand at the lows.

• Resistance is building near $0.23, where profit-taking and heavy sell orders reappear.

Technical Analysis

• Breakdown from $0.23 invalidates prior bullish structure, with $0.22 emerging as new short-term floor.

• Volume surge of 782 million DOGE validates capitulation selling — a potential precursor to bottom formation.

• Support: $0.22 (critical), followed by $0.21 if pressure persists.

• Resistance: $0.23 (immediate), $0.25 (major breakout threshold).

• Indicators suggest mixed signals: RSI approaching oversold, but momentum remains negative.

What Traders Are Watching

• Whether institutional accumulation continues if $0.22 cracks — signaling smart money conviction or retreat.

• Broader market risk sentiment: equity weakness and macro headwinds remain the dominant driver.

• $1 billion+ in crypto liquidations highlight fragility; another macro shock could deepen downside.

• A reclaim of $0.23 would be seen as a short-term reversal trigger, otherwise $0.21 support test is likely.

🔗 You Might Also Be Interested In

Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

BONK Holds Key Support as Volatility Grips Market

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!