Sentiment in the crypto industry can shift quickly.

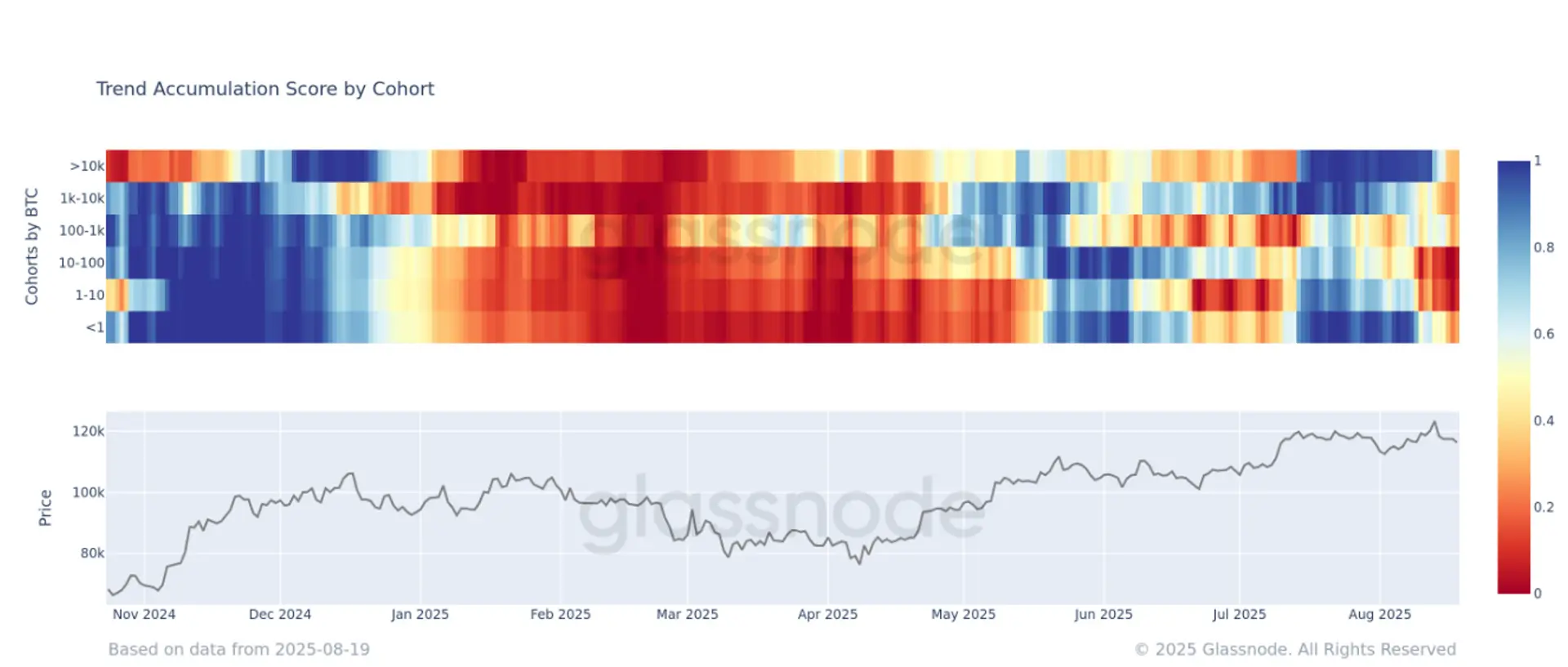

According to Glassnode data, all bitcoin (BTC) wallet cohorts are currently in some form of distribution. The Accumulation Trend Score (ATS), broken down by wallet cohort, helps measure the relative strength of accumulation or distribution across entity sizes.

This metric evaluates accumulation strength by considering both the size of the entities and the amount of bitcoin acquired over the past 15 days.

📖 Related Reading

-

📰 Bitcoin Slips Below $104K, Cryptos Slide as U.S.-China Tariff Tensions Flare Up

-

📰 Digital Assets Are One Step Closer to Regulatory Clarity

- A score closer to 1 indicates accumulation.

- A score closer to 0 indicates distribution.

Exchanges, miners, and certain other entities are excluded from the calculation.

At present, from large holders with more than 10,000 BTC to small wallets holding less than 1 BTC, all cohorts appear to be in distribution. This marks a sharp reversal from just over a week ago, when all groups were in accumulation mode as bitcoin reached new all time highs above $124,000.

The current phase of distribution reflects profit taking. Historically, bitcoin tends to correct shortly after setting new record highs. The aggregate Accumulation Trend Score has printed 0.26, remaining below 0.5 for the past several days.

Bitcoin has posted four consecutive green months from April through July. However, August is often characterized by quieter trading activity and reduced volume. In fact, the last three Augusts each saw corrections in the double-digit percentage range.

🔗 You Might Also Be Interested In

Bitcoin Slips Below $104K, Cryptos Slide as U.S.-China Tariff Tensions Flare Up

Digital Assets Are One Step Closer to Regulatory Clarity

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!