Dogecoin slipped below key support as late-session selling erased an earlier rally, with global trade tensions and fresh security concerns adding down...

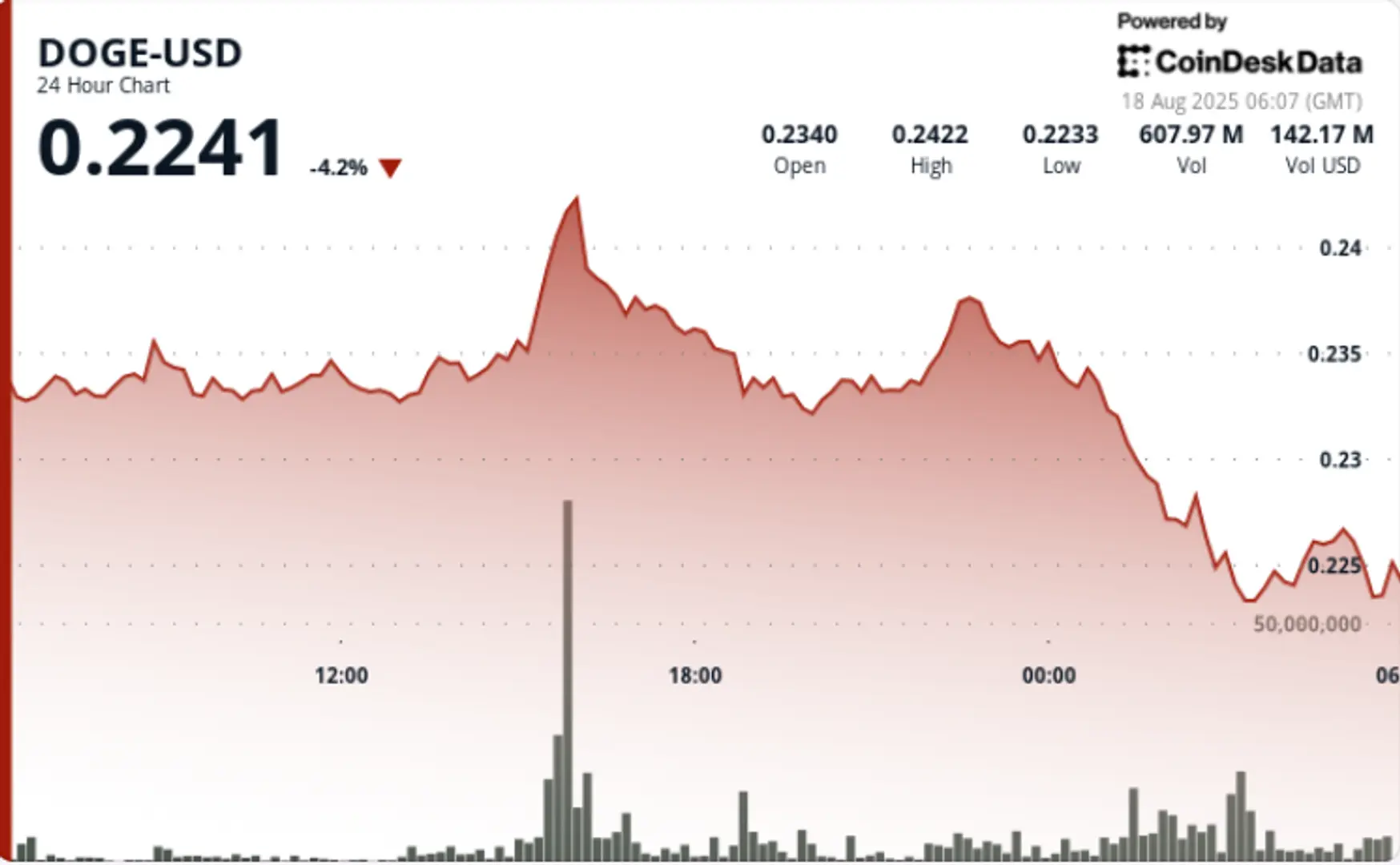

Dogecoin slipped below key support as late-session selling erased an earlier rally, with global trade tensions and fresh security concerns adding downside pressure.

Whale wallets continue to accumulate aggressively, with holdings now approaching 100 billion DOGE, but price action shows technical damage that traders will need to monitor closely.

News Background

- Whale wallets added 680 million DOGE in August, bringing total holdings to 98.56 billion tokens — the largest level in months.

- Qubic’s community voted to target the Dogecoin network for a potential 51% attack after recently executing one against Monero.

- Escalating global trade wars and tariff announcements fueled risk-off sentiment across crypto markets.

- DOGE’s bullish golden cross pattern (50-day above 200-day) failed to spark momentum as sellers overwhelmed bids.

Price Action Summary

📖 Related Reading

-

📰 Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

-

📰 Here’s what happened in crypto today

- DOGE declined 6% from $0.24 to $0.23 during the Aug. 17–18 trading window.

- The token swung violently in a $0.02 range, marking 7% intraday volatility.

- A midday surge to $0.24 on 916.22M volume was quickly reversed as bears sold into strength.

- Final session saw DOGE collapse 2% in one hour, breaking below $0.23 on 67.85M volume.

- Support at $0.23 failed, leaving the token vulnerable to further downside.

Technical Analysis

- Fierce resistance capped DOGE at $0.24, where repeated rejection sparked sell pressure.

- Key $0.23 support zone broke, eliminating near-term buyer interest.

- Volume spikes on breakdowns indicate continuation risk rather than reversal strength.

- Golden cross formation (50-day > 200-day) remains intact but has yet to yield upside confirmation.

- $0.23 now stands as the make-or-break level for recovery attempts.

What Traders Are Watching

- Whether whales sustain accumulation despite network security concerns.

- Confirmation of new downside targets if $0.23 fails to hold.

- Derivatives positioning after open interest surged past $10 billion.

- Any follow-through from Qubic’s community targeting Dogecoin with a 51% attack.

- Reaction to macro headlines on trade wars that continue to pressure risk assets.

🔗 You Might Also Be Interested In

Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

Here’s what happened in crypto today

Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!