Crypto markets saw over $1 billion in leveraged positions wiped out in the past 24 hours after hotter-than-expected U.S. Producer Price Index (PPI) data fueled fears of persistent inflation and delayed Federal Reserve rate-cut expectations.

The sell-off came hours after bitcoin hit a fresh all-time high above $123,500, with traders unwinding risk across the board. Major memecoin dogecoin (DOGE) fell 9% to lead losses among majors, with Solana’s SOL, XRP, and BNB Chain’s BNB dropping between 3-7%.

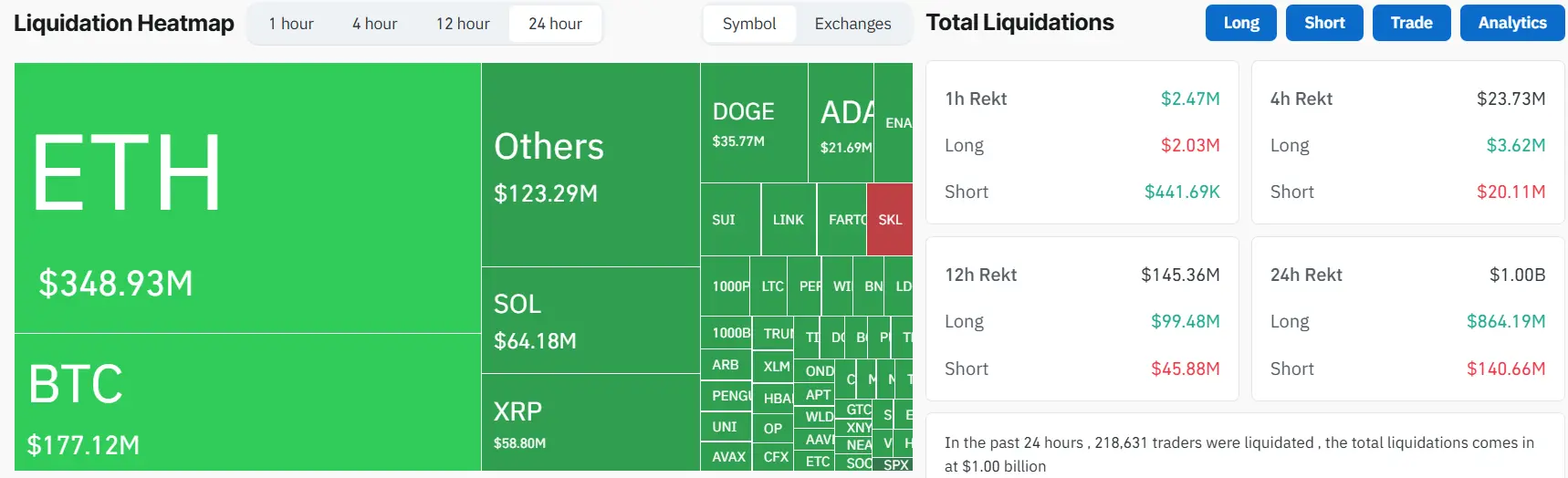

Liquidation data shows $866 million in long positions were erased — more than six times the $140 million in shorts — as prices reversed sharply from recent highs.

Ether traders took the biggest hit, with $348.9 million liquidated, followed by Bitcoin at $177.1 million. Solana, XRP, and Dogecoin saw $64.2 million, $58.8 million, and $35.8 million in liquidations, respectively.

📖 Related Reading

- 📰 Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

- 📰 Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

Bybit accounted for the largest share of the wipeout, at $421.9 million, with more than 92% of those losses stemming from overleveraged long positions. Binance followed with $249.9 million in liquidations, while OKX saw $125.1 million.

The largest single liquidation was an ETH-USDT perpetual swap worth $6.25 million on OKX.

Jeff Mei, COO at BTSE, said the inflation surprise “put the brakes on an incredible crypto rally this past week,” adding that markets are likely to “hover around their current levels until more positive guidance comes from the Fed.” He noted the ongoing “threat of inflation continues to persist and could impact the likelihood of rate cuts in September.”

Nick Ruck, director at LVRG Research, pointed to the broader macro pressure on crypto’s recent gains.

“This week in crypto saw BTC reaching a new all-time high but later impacted by macroeconomic tremors,” he said in a Telegram message. “Inflation surged much higher than expected, reinforcing fears of sticky inflation and delaying Fed rate-cut expectations."

“The sell-off underscores crypto’s growing sensitivity to macro liquidity shifts, with traders now eyeing labor metrics in early September for clues on the Fed’s next move. We’re optimistic that the market will rebound as the fundamental values of crypto driving the bull run remain in place,” Ruck added.

Traders are now watching U.S. economic data releases and Fed commentary closely, with September shaping up as the next major inflection point for monetary policy.

🔗 You Might Also Be Interested In

Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

Crypto Market Cap Halts at $3.7T as Traders Rotate Out, Institutions Double Down on BTC, ETH

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!