Technical Analysis Overview

XRP jumps 11% in the 24-hour period ending August 11, moving from $2.90 to highs of $3.27 before settling at $3.22. The breakout comes as institutional trading volumes spike 208% to $12.40 billion following the formal dismissal of the SEC’s case against Ripple Labs.

Open interest in derivatives rises 15% to $5.90 billion, underscoring aggressive positioning from large players.

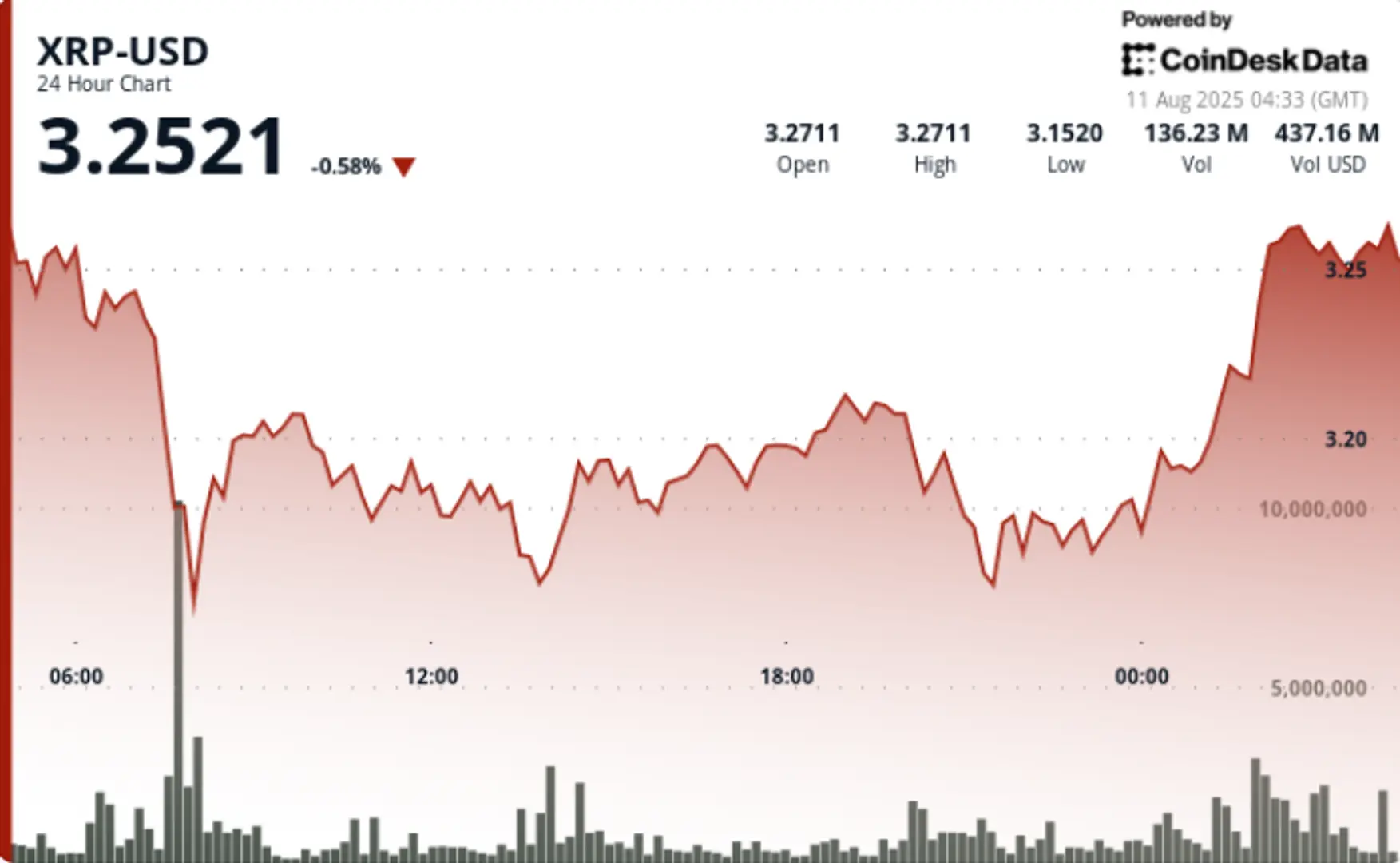

Price action shows early-session volatility, with a sharp drop from $3.24 to $3.16 during the 07:00 hour on 144.54 million volume. Buyers defend the $3.15-$3.16 zone, triggering a late-session push that breaks $3.22 resistance and holds above $3.24 into the close.

News Background

The Securities and Exchange Commission and Ripple Labs officially ended their multi-year legal battle, jointly dismissing appeals in the XRP case. The resolution removes a long-standing regulatory overhang and opens the door for broader corporate and institutional adoption.

The rally comes alongside heightened derivatives activity and bullish technical setups, with some institutional research desks targeting $4.50-$5.00 as potential medium-term upside.

Price Action Summary

📖 Related Reading

- 📰 Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

- 📰 Decentralized Finance and Tokenization Growth Still Disappoints: JPMorgan

• XRP gains 11% as price breaks above $3.00 psychological barrier on surging institutional volumes

• $3.15-$3.16 emerges as strong accumulation zone following 07:00 selloff from $3.24

• Late-session breakout clears $3.22 resistance on sustained large-order flow above 4 million units

• Session range spans $0.11 (3% volatility) between $3.27 high and $3.15 low

Market Analysis and Economic Factors

Regulatory clarity triggered aggressive corporate treasury rebalancing and new speculative inflows from institutional desks. The $3.15 support zone now acts as a key reference for short-term risk management, while $3.24-$3.27 serves as near-term resistance.

Breakout confirmation above this band could accelerate momentum toward higher technical targets, especially if ETF-related flows in Japan spill over into U.S. markets.

Technical Indicators Analysis

• Volume surge to $12.40B, up 208% from prior day

• Open interest climbs 15% to $5.90B, signaling leveraged positioning

• Resistance: $3.24-$3.27; Support: $3.15-$3.16

• Breakout above $3.22 confirmed by late-session institutional flows

• Technical setup aligns with breakout from multi-month consolidation

What Traders Are Watching

• Follow-through above $3.27 to validate breakout toward $3.50+

• Sustainability of large-holder accumulation post-regulatory resolution

• Impact of derivatives positioning on spot market volatility

• Potential spillover from Japan’s SBI Bitcoin-XRP ETF filing

🔗 You Might Also Be Interested In

Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

Decentralized Finance and Tokenization Growth Still Disappoints: JPMorgan

The Future of Digital Asset Infrastructure in Latin America

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!