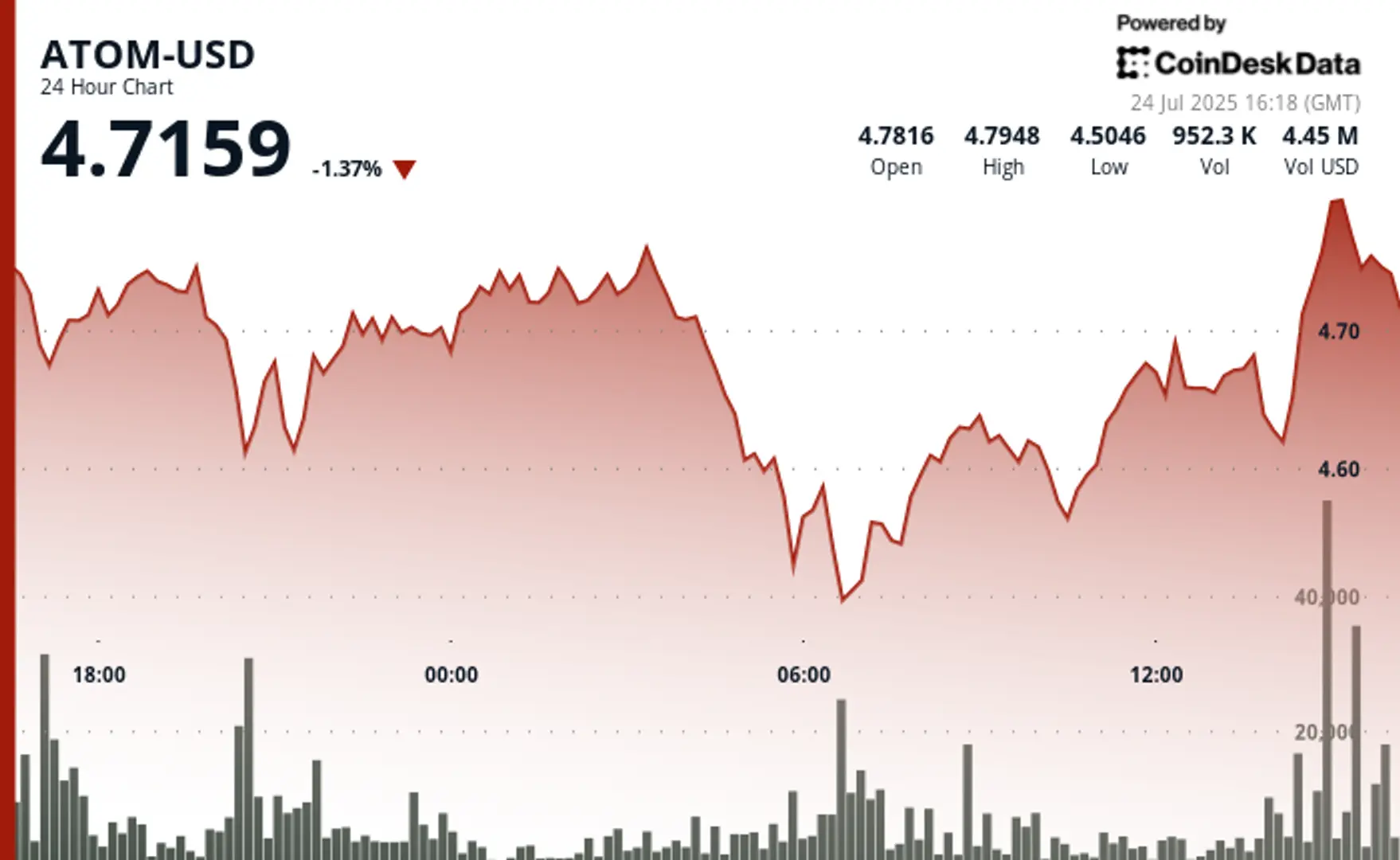

After a heavy bout of selling pressure during the early hours of July 24, ATOM demonstrated impressive resilience, rebounding from an intraday low of $4.47 to close the session at $4.77. The 7% swing within 24 hours—defined by a peak at $4.82 and a low at $4.47—was supported by heavy volume exceeding 2.28 million units, signaling strong interest at the lower boundary. The rapid absorption of sell-side pressure and the subsequent recovery reflect a robust technical foundation, with $4.47 now emerging as a key support level to watch.

Zooming into the final hour of trading, ATOM managed a further display of bullish resolve. It opened the hour at $4.69 and mounted a sustained rally, briefly breaching the $4.80 resistance zone on volume exceeding 77,000 units. While that push higher was met with fast distribution near the top, leading to a late-session dip back to $4.74, the token still notched a 1% gain for the hour. The pattern underscores opportunistic profit-taking near resistance but doesn’t negate the constructive tone built from the morning recovery.

ATOM’s strong showing comes at a time when broader market sentiment is shifting. After a week that many dubbed “altcoin season” with rampant gains across second-tier tokens, the tide appears to be turning. Several altcoins are now seeing pullbacks, weighed down by shifting risk appetite and the gravitational pull of BTC and ETH volatility. In that context, ATOM’s ability to hold higher ground and attract volume at key levels suggests it may be better positioned than peers to weather this cooling phase in the altcoin cycle.

📖 Related Reading

- 📰 Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

- 📰 CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Technical Indicators Highlight Key Levels

- Overall trading range of $0.33 representing 7% fluctuation between $4.82 maximum and $4.47 minimum.

- Strong volume support established at $4.47 level with trading exceeding 2.28 million units.

- Critical resistance threshold identified at $4.80 with elevated volume exceeding 77,000 units.

- Recovery momentum from $4.47 low to $4.77 close indicating buyer absorption of selling pressure.

- Late-session profit-taking activity near resistance levels while maintaining bullish trajectory.

** Disclaimer:** Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

🔗 You Might Also Be Interested In

Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Thai SEC opens consultation period for token issuance rules

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!