Binance Coin (BNB) is showing resilience after a stormy week for financial markets, as Israel attacked Iran in a bid to limit its nuclear program and missile capabilities, leading to a large-scale missile attack in response.

The conflict saw investors flee risk assets and led to more than $700 million in liquidations in the crypto market in just 24 hours, according to CoinGlass. BNB, however, managed to maintain a narrow trading range of just over 1%, resisting a broader altcoin pullback.

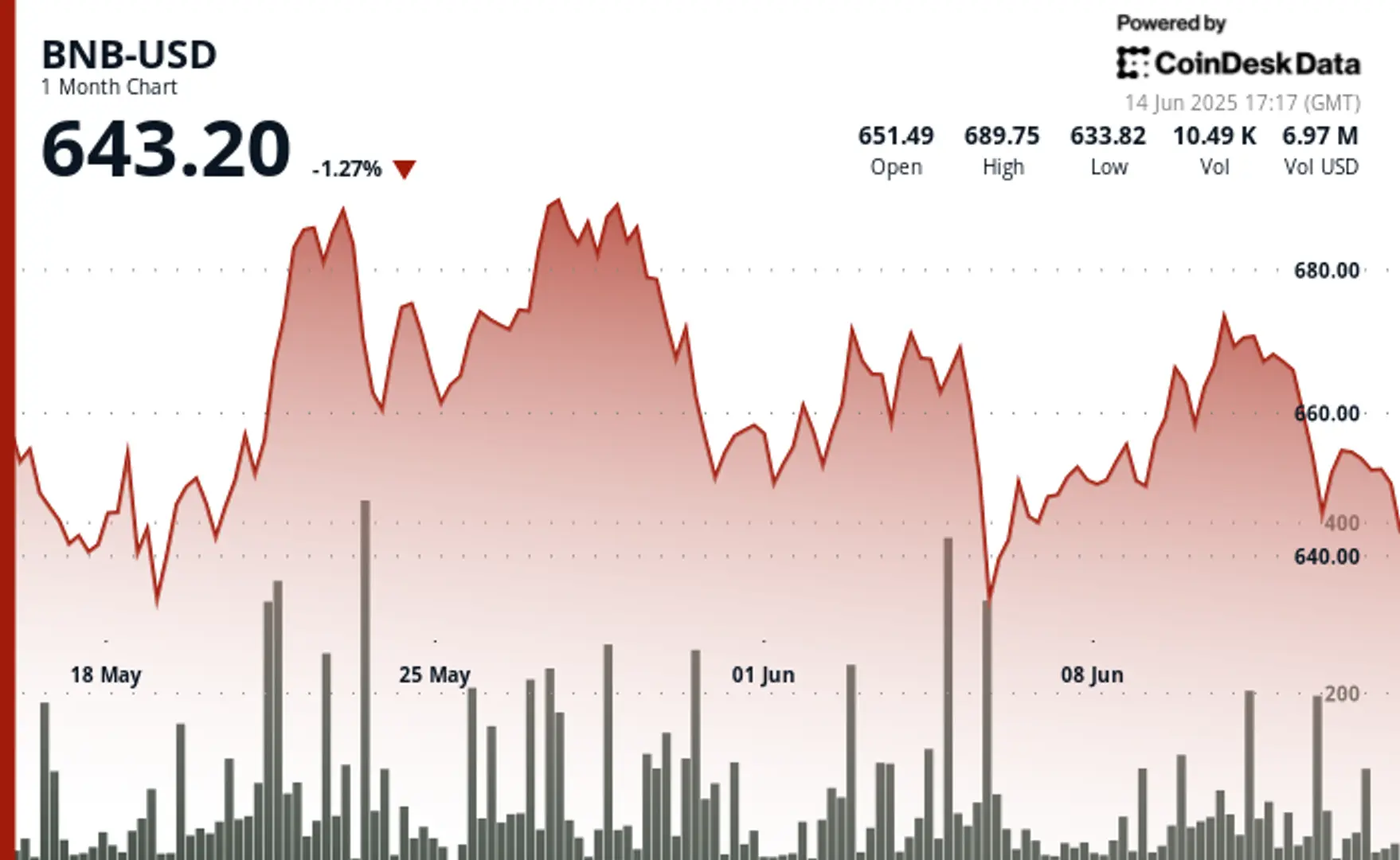

BNB, after the sell-off, failed to break above $660, its immediate resistance level according to CoinDesk Research’s technical analysis data model, and has since been consolidating within a symmetrical triangle pattern.

Despite the setback, the coin has stayed above key support at $640, a zone aligned with the 78.6% Fibonacci retracement level. Trading volume analysis suggests sellers dominate near $655.5, while a buyer base forms around $649, the model shows.

📖 Related Reading

- 📰 Bitcoin Slips Below $104K, Cryptos Slide as U.S.-China Tariff Tensions Flare Up

- 📰 Digital Assets Are One Step Closer to Regulatory Clarity

Technicals signal a mixed picture. The Moving Average Convergence Divergence (MACD) turned negative, and the Relative Strength Index (RSI) sits just under 50, hinting at fading momentum.

Yet the 50/200-day moving averages are nearing a golden cross, and the Chaikin Money Flow indicator remains positive, a setup that has historically preceded upward reversals, according to the model.

But sentiment around BNB isn’t all bullish. Net Taker Volume, a gauge of aggressive sell pressure, hit a multi-week low of -$197 million.

Meanwhile, even as Binance Smart Chain’s perpetual trading volume rose exponentially month-over-month, this activity doesn’t appear to have sparked new demand for BNB. Futures open interest remains down more than 30% from its December peak.

🔗 You Might Also Be Interested In

Bitcoin Slips Below $104K, Cryptos Slide as U.S.-China Tariff Tensions Flare Up

Digital Assets Are One Step Closer to Regulatory Clarity

Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!