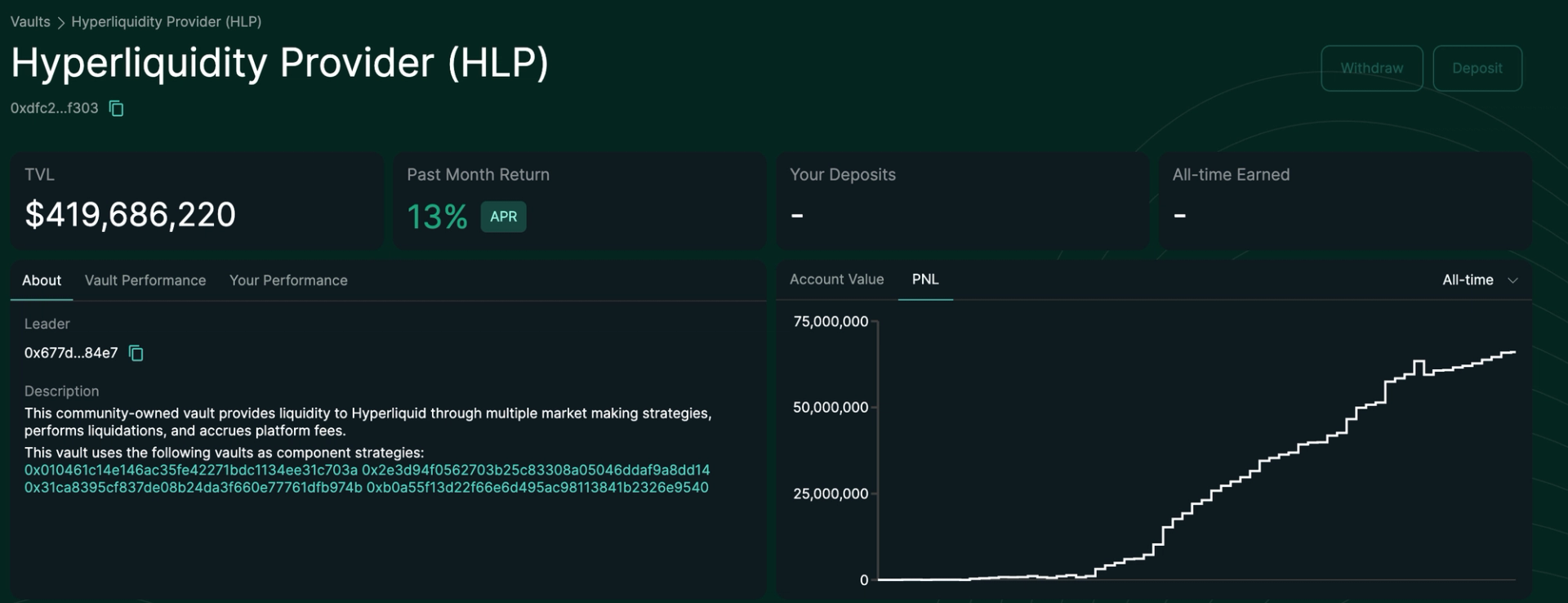

The yield-bearing vault created by decentralized exchange HyperLiquid has grown from $163 million to $418 million over the past two months despite centralization concerns around the JELLY market fiasco in March, data from DefiLlama shows.

The vault, which acts as an internal market maker and gives depositors a yield, was underwater by $13.5 million after a user manipulated the index price of JELLY in March.

HyperLiquid minimized these losses by forcibly closing the JELLY market, settling it at $0.0095 as opposed to $0.50 that was being fed to oracles via decentralized exchanges.

📖 Related Reading

- 📰 Polygon NFTs hit $2B sales milestone as network defies downturn

- 📰 Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

This led to an exodus of capital from the HyperLiquid platform, total value locked (TVL) dropped from $510 million to $150 million while the HYPE token suffered a 20% downturn.

But all was soon forgotten in part due to the emergence of James Wynn, a derivatives trader that made and lost $100 million on HyperLiquid in a week. His public trades and commentary generated a wealth of bullish sentiment around HyperLiquid as the platform managed to handle the nine-figure positions in terms of liquidity and slippage.

📖 Related Reading

- 📰 Here’s what happened in crypto today

- 📰 Ethereum Foundation Unveils New Treasury Policy With 15% Opex Cap

Over that period, TVL increased along with HYPE, which is now up by 72% in the pat 30-days.

The HyperLiquid vault is currently returning 13.42% in annual interest, beating various restaking protocols that offer around 9.1%.

📖 Related Reading

- 📰 Here’s what happened in crypto today

- 📰 Ethereum Foundation Unveils New Treasury Policy With 15% Opex Cap

🔗 You Might Also Be Interested In

Polygon NFTs hit $2B sales milestone as network defies downturn

📖 Related Reading

- 📰 Here’s what happened in crypto today

- 📰 Ethereum Foundation Unveils New Treasury Policy With 15% Opex Cap

Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!

🔗 You Might Also Be Interested In

Here’s what happened in crypto today

Ethereum Foundation Unveils New Treasury Policy With 15% Opex Cap

$302 Million Lost to Crypto Scams, Hacks, and Exploits in May: CertiK

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!

🔗 You Might Also Be Interested In

Here’s what happened in crypto today

Ethereum Foundation Unveils New Treasury Policy With 15% Opex Cap

$302 Million Lost to Crypto Scams, Hacks, and Exploits in May: CertiK

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!

🔗 You Might Also Be Interested In

Here’s what happened in crypto today

Ethereum Foundation Unveils New Treasury Policy With 15% Opex Cap

$302 Million Lost to Crypto Scams, Hacks, and Exploits in May: CertiK

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!