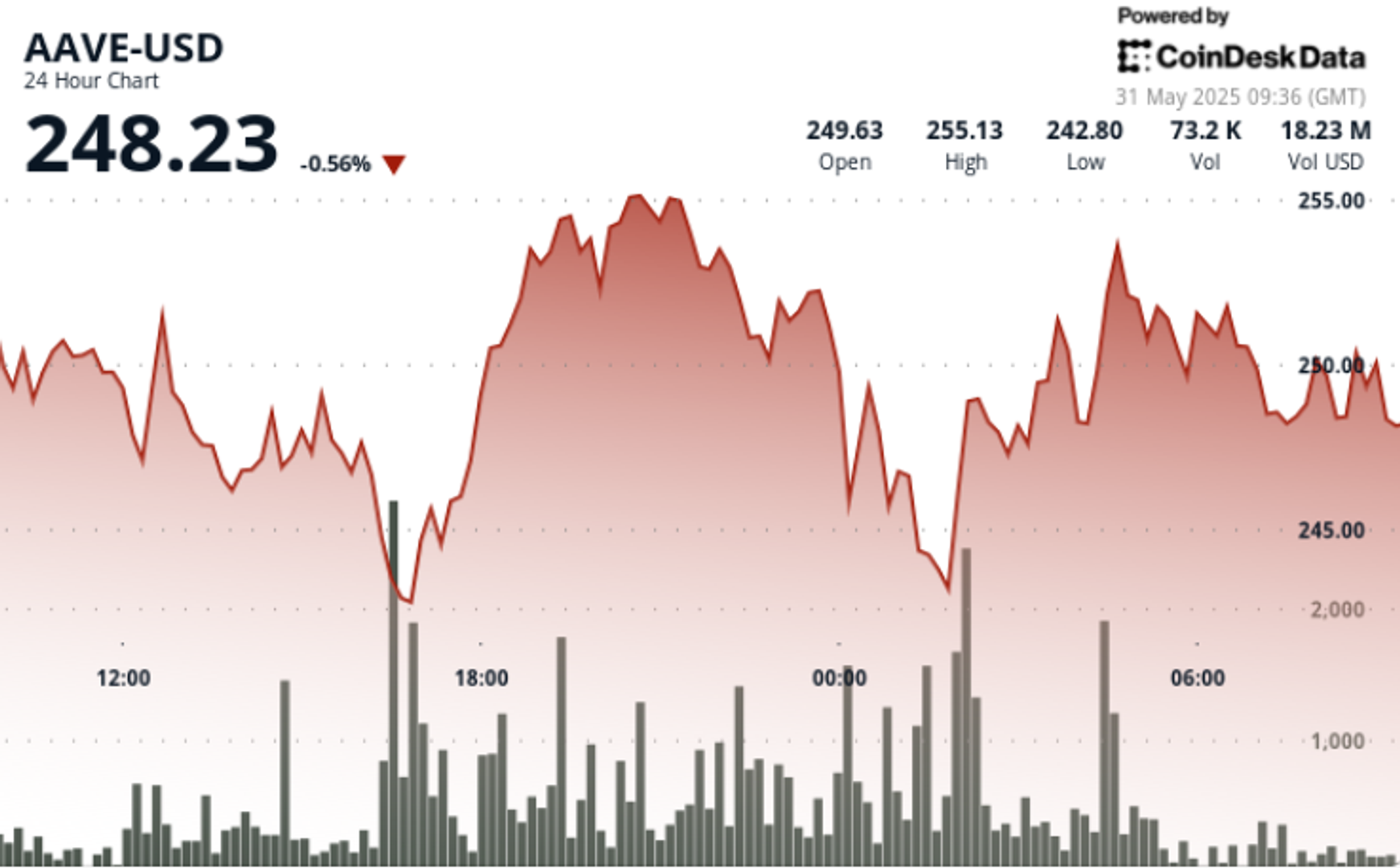

AAVE has demonstrated remarkable resilience in the face of global market turbulence, rebounding from a 15% price drop over four days as buyers stepped in to capitalize on DeFi’s growing momentum.

The protocol’s price climbed from $240 to above $250, buoyed by expanding tokenized yield markets that are drawing increased institutional and retail interest.

The price action comes as global trade tensions and new tariff uncertainties — including reports of China violating its trade agreement with the U.S. — injected volatility across risk assets.

Despite these headwinds, the DeFi sector is showing renewed strength, with total value locked (TVL) surging to $178.52 billion. AAVE remains a key leader in the space, commanding a TVL of $25.41 billion.

📖 Related Reading

- 📰 Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

- 📰 CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

News Background

- A key driver of AAVE’s recent rebound has been its integration with Pendle’s tokenized yield markets, which saw new markets reach their supply caps within hours of launch, underscoring the strong demand for yield-generating products in the DeFi ecosystem.

- The Ethereum Foundation (EF) borrowed $2 million in GHO, Aave’s decentralized stablecoin pegged to the U.S. Dollar, earlier this week.

- This move, facilitated by supplying ETH as collateral, highlighted EF’s strategy of leveraging its crypto holdings to fund operations while supporting Aave’s protocol.

- Aave’s GHO stablecoin is fully overcollateralized within the Aave ecosystem, with EF’s loan backed by 1,403,519.94 Gwei of ETH (valued at $0.01 in the transaction).

- Interest payments on this loan support Aave’s DAO treasury, reinforcing a community-driven financial model that incentivizes participation and governance.

- Aave’s lending dominance is underscored by its 45% market share from January 2023 to May 2025, according to IntoTheBlock data.

- This figure highlights Aave’s steady recovery from the 2023 DeFi dip and cements its status as the largest decentralized lending protocol by volume and activity.

📖 Related Reading

- 📰 Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

- 📰 CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Technical Analysis Recap

- AAVE established a high-volume support zone around $242.70 during the 16:00-17:00 and 01:00-02:00 hours, attracting strong buying with volumes exceeding 90,000 units.

- A bullish ascending triangle pattern formed, with higher lows indicating accumulation despite recent resistance.

- After peaking at $255.96 at 20:00, AAVE set resistance at $253.75 before stabilizing at $248-$250.

- A notable volume spike between 07:51-07:52 coincided with a sharp rise from $248.98 to $249.82, creating a new resistance level.

- A cup-and-handle pattern formed, with the handle developing between 07:56-08:00, suggesting accumulation after the recent pullback.

- Short-term consolidation near $249, coupled with increasing volume on upward moves, hints at potential bullish momentum building for a test of $250 resistance.

As DeFi yield markets continue to expand, AAVE’s ability to integrate new products and sustain high-volume support levels positions it as a key player in the sector’s growth — despite the broader market’s macroeconomic challenges.

📖 Related Reading

- 📰 Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

- 📰 CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

🔗 You Might Also Be Interested In

📖 Related Reading

- 📰 Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

- 📰 CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Here’s what happened in crypto today

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!

🔗 You Might Also Be Interested In

Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Here’s what happened in crypto today

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!

🔗 You Might Also Be Interested In

Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Here’s what happened in crypto today

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!

🔗 You Might Also Be Interested In

Classover Taps $500M Convertible Note Deal to Boost Solana Treasury Strategy

CFTC’s Goldsmith Romero says commissioner exodus ‘not a great situation’

Here’s what happened in crypto today

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!